The recent online money lending revolution has made the accessibility of finances quick and easy. Digido, a Philippine-based online lender, leverages the growing fintech developments to provide Filipinos with fast online loans against zero collateral. The state-licensed company initiated its operations in 2021, becoming one of the most preferred online credit services in the Philippines. Today, Digido Philippines offers more versatile online lending features, supplying clients with greater possibilities for loans.

Usually, most Philippines are caught up in bank queues in search of formal banking services, including loan applications. The problem with such banking setups is that acquiring money for urgent financial needs can be quite an uphill. Fortunately, with Digido, you do not have to walk into a traditional bank or have to deal with the annoyance of endless paperwork to get a loan. Visit the website or browse through the Digido Mobile App and earn yourself an opportunity for an instant online loan.

About Digido Philippines – Is the Company Legit?

Formerly, Digido Philippines, a product of Digido Finance Corp, was registered as Robocash PH. It was rebranded into Digido Philippines with an aim of improving its service versatility and accommodating more clients.

So, is Digido Legit or not? Regarding legislation, financial companies in the Philippines are required to have proper authorization to function by the Securities and Exchange Commission (SEC). According to SEC, Digido Finance Corp is a legal entity with a verified Certificate of Authority. The Commission’s website https://www.sec.gov.ph/ confirms the approval of Digido as a legitimate financing company certified with registration number CS202003056. In Summary, Digido Philippines is legit.

The registration details of Digido can be summarised as follows;

- Registration Status – Licensed

- Company Name – Digido Finance Corp

- Certificate of Authority – 1272

- SEC Registration Number – SEC CS202003056

- Address – UNIT 2/C, Murphy Centre, 187 Bonny Serrano Road, Socorro, QUEZON CITY SECOND DISTRICT, NCR, Philippines 1109.

Advantages of Borrowing Money from Digido

Here are reasons why Digido is a preferred online loan lender.

Monthly Installment Loans

This online lender offers monthly installment loan terms where users borrow funds and repay in either 3, 4, 5, or 6 months from the date of loan approval. This loan duration makes it easy for individuals who rely on payday for monthly payments.

Fully Automated Online Loans

You can get up to PHP 25,000 with a click of a button. The entire process is automated, offering you money in just 15 minutes.

No Hidden Charges

Digido Philippines is highly transparent when it comes to loan details and repayment information. From payment terms and interest rates to fees and related charges, every detail is at your disposal before the loan is processed.

Multiple Repayment Options

Unlike traditional banking methods, this Filipino online lender allows users to pay loans online in over 30 repayment options. Such channels include 7-Eleven, Bank of Commerce Online, BDO Internet Banking, Metrobank Internet Banking, and Chinabank Cash Payment.

Types of Loans Offered from Digido

Digido Philippines is ideal for individuals looking for instant and emergency loans. Whether you are sourcing for funds to clear a medical bill, consolidate debt, or utility bill payment, this Filipino online lender is the go-to option for quick cash.

However, before you apply for a Digido loan, you will need to understand the types of loans offered by the platform. In general, there are two types of loans offered by the loan service in the Philippines, including First Loans and Digido Reloans.

Digido First Loan

This is the first loan that the lender offers to its first-time clients. The first loan is issued within the limits of PHP 1000 and PHP 10,000 for a period of up to 7 days. Interestingly, Digido’s first loan is interest-free, allowing you to repay an amount equal to the principal initially borrowed.

Reloan

Reloans are loans offered to repeat borrowers subsequently after repayment of their first loan. Digido reloans are issued within the limits of PHP 1,000 and PHP 25,000 for a period of up to 1 month or 30 days.

How to Apply and Get Your Loans

Here are the 3 basic steps to getting this online loan.

Create an Account with the Lender

The first step is to secure your space over the Digido web and app spaces. Essentially, this step is designed to help users show proof of their identity by filling out a personal data form.

Choose the Method of Receiving the Loan

The loan company partners with multiple financial institutions to help users receive loans online in the most convenient way.

Sign the Contract

The idea of contract signing is for users to consent to the reception of a loan. Subsequently, a confirmation code is sent to you via a text message, and the loan is processed instantly.

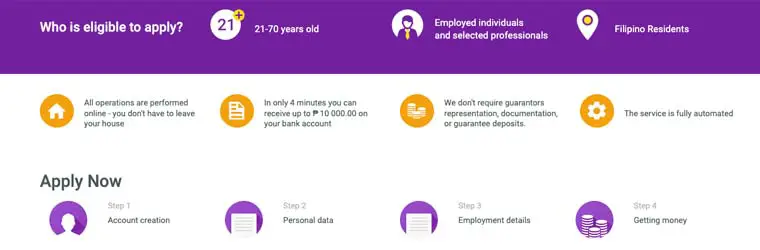

Documentation Required

The Digido loan requirements are quite fair compared to other online loan providers in the Philippines. All Filipino citizens aged 21 to 70 years are eligible for a loan with this online lender. However, one must include the following documents during the loan application.

- Proof of Citizenship Documents, such as Government-Issued ID Card, Valid Driving License, Philippine Passport, Unified Multipurpose ID, or SSS.

- Proof of Income/Employment Documents, such as Pay slips, Company ID, COE, DTI, and/or ITR.

- Registered Phone Number

While proof of income or employment documents are not compulsory for a loan application, the inclusion of either or all of these documents increases the chances of loan approval.

The Application Process

This Filipino online lender offers you an instant loan disbursed to your bank account of choice in less than 15 minutes. While on the Digido mobile app or website, look for the ‘Apply Now’ and click on the button. This will lead you into the 4-phase process of a loan application.

Here is an overview of the application process.

Step 1

Account Creation

If you do not have a Digido Account, you will be required to create one first before filling in the platform’s online application form. Click on the sign-in button if you already have an existing account. You will be required to provide personal details, such as phone number, email address, and full names. While filling the Name Section, your First Name comes first, while your Last Name comes last.

Step 2

Read and Agree to the Terms and Conditions

Ensure that the ‘I Have Read and Agreed with the Privacy Notice and Terms & Conditions’ button is ticked before proceeding to the next phase.

Step 3

Other Relevant Information

For higher approval chances, you will be required to upload such documents as address details and proof of job or income documents.

Step 4

Receive the Money

Select your method of receiving the money, input the confirmation code, and get your money instantly upon approval.

How Long Does It Take to Get Approved?

After signing the contract by confirming the application using the SMS Code sent to your number, the requested amount is disbursed to your account immediately. This happens instantaneously in not more than 10 minutes.

However, the speed of receipt of the loan into your account varies with different banks and credit institutions. While some banks process the cash loan almost instantly, some financial institutions may take up to 2 working days.

Ways to Get Your Money

Users can obtain this online loan via a Credit Card or Debit Card. Add a Debit/Credit Card from your preferred bank to your Digido Account during registration. The system will confirm the validity of your bank details through a Code sent to you via SMS. Once approved, the loan service will disburse your requested amount to the attached Credit/Debit Card.

If you are uncertain of your Credit/Debit Card details, you can call your bank agent or visit your bank for confirmation.

Modes of Payment

As the rule goes, the earlier you repay an online loan, the higher the chances of incurring a smaller interest rate. You also earn greater chances for reloans. This Filipino online lender offers over 30 modes through which loan repayments can be done, each of which comes with a set of instructions on how to make such payments.

Here is a list of some of the modes of payment featured at Digido.

- Unionbank

- 7-Eleven (Payment Centre)

- AUB Online/Cash

- UCPB

- Banco de Oro ATM

- The Union Bank of the Philippines, Inc.

- Bayad Centre

- Robinsons Bank

- ShopSM Department/Counter

- BDO Cash Deposit w/Ref

- Security Bank Cash Payment

- BDO Internet Banking

- RuralNet Banks and Coops

- BPI Cash Payment / Online Banking

- Cebuana Lhuillier

- RCBC Online Banking

- China Bank Cash / Online Payment

- RCBC ATM/Cash Payment

- Coins.ph Wallet/Bitcoin

- EastWest Online/Cash Payment

- GCash

Digido Loan App

Recently, Digido Finance Corporation developed the Digido Loan App, a mobile application loaded and optimized with fintech features. As the number of smartphone owners continues to grow sporadically in the Philippines, the demand for a money lending app has skyrocketed. This online loan app is built to assist tech-savvy users to access instant loans in a quick and seamless way. Both Apple and Android users can leverage the benefits of this app by downloading it on Apple Store and PlayStore respectively.

The Mobile App also features the Digido Philippines Calculator, a tool built to enable users to determine the exact repayment value for every loan under a specified repayment term. Different residents of the Philippines using this app have given highly favorable feedback regarding its effectiveness and versatility.

Note that the online loan approval policies, the interest rate, and charges do not change with the mobile app.

Digido Philippines Customer Service

Getting the right support can be a nightmare for most online lenders and fintech services. This is because the entire money borrowing process is done over the web, with close to zero interaction with the Company’s personnel. Fortunately, for Digido Philippines, users can reach the firm’s customer support team through the communication channels provided on its website.

The Digido Customer Support team is available to respond to queries and address arising issues from 8 am to 5 pm every day of the week. Customers can reach out to the support team via calls at (02) 8876-84-84 or through email at support@digido.ph.

You can also air out your discrepancies and complaints by filling in the online Customer Support on the website’s Contact Us Page https://digido.ph/about.

Before raising concerns and queries to the platform’s support team, you might want to go through their Terms and Conditions and Consent policies. This way, you are aware of why and how the online lending service works for informed complaints.

Conclusion

With the growing rise in fintech companies, online loans and borrowing is becoming exceedingly popular. More Filipinos are looking for channels that can provide instant funds to service their bills and other financial needs. Digital comes to fulfill that need by offering its users emergency loans in a more seamless way. The company has accumulated a track record and undisputed reputation for financing small businesses and individuals at a reasonable interest rate. Its mobile app makes online borrowing even more convenient than ever before.