When going for quick loans, the primary concern, for most people, is to find a reliable and reputable lender with the capacity to provide instant cash in the shortest time possible. The Union Bank of the Philippines has held that flag high, with a record of being a leading financial institution in the region. As a digital lender, Union Bank features a wide range of loan options, including auto, personal, and home loans. You are qualified for a portfolio of quick loans as long you have a registered current account with the institution

About UnionBank

For decades, UnionBank has maintained its prominence as the leading digital bank in the Philippines. Rated as the country’s best bank for SMEs and online services, there is no doubt that UnionBank is one of the most preferred banking options among Filipinos. According to the Securities and Exchange Commission, the bank is fully registered under the laws of the Philippines and duly licensed to operate as a financial institution.

On matters of ownership, Union Bank is co-owned by various shareholders, including the Insular Life Assurance Company, Social Security System, and Aboitiz Equity Ventures. Additionally, UnionBank is listed on the Philippine Stock Exchange, offering over 4% of its shareholding to the public.

Notably, the Union Bank of the Philippines has always been at the forefront of embracing technological innovations and integrating them into its operations. As a result, the institution is the go-to financial service provider for corporates, fintech businesses, MSMEs, and individuals.

Why Choose UnionBank’s Quick Loan?

Here is why you should go for a UnionBank Quick Loan.

Simple Application Process

Getting a quick loan at Union Bank is easy and fast. The process is completed over the internet by filling out an online form and following basic guidelines.

Instant Money

Immediately you get approved for a loan, it takes Union Bank about 60 seconds to process the loan proceeds to your account.

Reputation

Union Bank is a household name in the Philippines. You can never go wrong with a UnionBank quick loan.

International Money Remittance

Unlike most online lenders, Union Bank has extended operations across Asia and other parts of the world. Users can rely on the service to transmit the borrowed money globally.

Customer Service

UnionBank is known for its great customer service. You can get contacts for the customer support team in your region anytime from the bank’s website. Also, Union Bank features a Help Centre that helps you with all service-related inquiries.

How to Apply and Get Your Loan

First, you must be a recognized current account holder with Union Bank to qualify for quick loans with Union Bank. Additionally, you are required to create an online account with the lender through which you can make your loan application.

There are 2 methods available to create a Union Bank online account and apply for a loan.

Union Bank Website

On the website https://www.unionbankph.com/loans/quick-loan, you will be required to provide the various credentials to get quick loans. Such details include a unique invite code, mobile number, email address, and payroll account number.

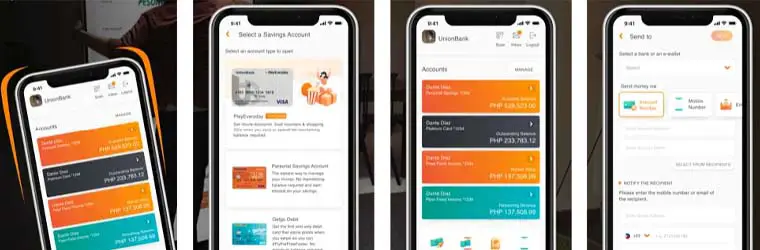

Union Bank Mobile App

The UB App is available for download on Apple Store, Google Playstore, and Huawei App Gallery. Once you sign up to Union Bank, you can get your quick loans instantly via the app.

Documentation Required

The various types of documentation required to qualify for quick loans With UB vary with the applicants. These documents can be classified as follows;

Personal Information

- Copy of one government-issued Identification document. Must be accompanied by a photo and signature.

- Where necessary, marriage contract copy.

- Union Bank Quick Loan application form (completely filled).

Employment Credentials

- Latest employment certificate

- Latest monthly payslips (at least 3)

- Business registration (for the self-employed)

- Bank Statements

- Suppliers List (for registered businesses)

- Income Tax Return

Overseas Filipino Worker

- Valid passport

- Special Power of Attorney

Getting an Invitation Code

An invitation code is a unique set of numbers sent to preexisting and prequalified customers via SMS or email. This is the code loan applicants use to proceed with the application process.

Essentially, the Union Bank of the Philippines applies multiple factors for prequalification. This means that Union Bank quick loans are not accessible to everyone, and getting this code is the ticket to qualification.

To get the Invitation Code, visit the Union Bank website or mobile app, fill out the necessary details as required, and wait for notification. You must have duly registered as a member of Union Bank to get this code.

The Application Process

The process of applying for Union Bank quick loans is simple. Here are a few steps to follow.

Step 1

Account Creation

Sign up with Union Bank via their website/app. Provide the necessary documents as guided. You must also have a current bank account with Union Bank to get a loan successfully.

Step 2

Invitation Code

Having registered as a member of Union Bank, you will be prequalified for a loan through an invitation code. The code is your access to the remaining phases of the loan application process.

Step 3

Login

Log in to your Union Bank account using the invitation code sent to you via email or SMS. Such credentials as mobile number, email address, payroll account number, or the invite code may be used to log in.

Step 4

Application

Once logged in, you will be redirected to a page showing details, such as the interest rate for the specified loan amount, fees, disclosure statement, and terms and conditions. You must consent to the terms and conditions to complete the application process.

Step 5

Loan Disbursement

Wait for a notification showing approval and disbursement of your loan proceeds.

Obtaining Your Loan

You can obtain your loan through either of the following ways;

- Union Bank Mobile Bank -Through your loan account, the money is deposited into your Union Bank current account. You can then withdraw, transfer, or transact using the UB Mobile app.

- Union Bank ATM Card – If you have a Union Bank ATM Card, then you can access your money at any ATM machine.

- USSD Dialing – You can use the *826# USSD Code to access your Union Bank quick loan.

Ways to Make Payments for Your Union Bank Quick Loan

There are plenty of ways through which payments for Union Bank quick loans can be settled, including;

- Union Bank Auto-Debit – Ensure your UnionBank account is funded, and the lender will automatically deduct your monthly repayments when the date is due.

- Over-the-Counter Payments – Visit any UB branch and make payments over the counter.

- UnionBank Quick Loan App – The UB app has a Pay Bill feature that allows you to process payments to various targeted institutions, including paying out your loan.

- Digital Wallets – Digital wallets, such as Upay, Pesonet, and Instapay are also a great option for UnionBank loan repayment.

- UnionBank Partners – The Union Bank of the Philippines has thousands of partner outlets globally, including ECPay, PayMay, and GCash. Input your loan account number, installment, and name in any of the partner’s platforms. The money will be billed automatically.

UnionBank App

The UnionBank App is a versatile tool created to allow users to run all their banking activities anywhere at any time. Interestingly, you can access your finances via the UnionBank App 24/7, giving you flexibility and convenience without having to pass by a bank.

Such features as the ‘Pay Bills,’ ‘Transfer Money,’ and ‘Check Deposit’ are designed to help you do more with mobile banking in the comfort of your home or office. Also, you can monitor the flow of your finances with ease, facilitating enhanced financial management.

UnionBank Help Centre

The UB Help Centre is where you find answers to all the questions running in your mind. From account opening and quick loan concerns to security and feature-based inquiries, the Help Center will highlight what you are looking for in the easiest way you can understand.

In the Search Box, input the keywords to your concerns, and a dropdown list of related questions will pop up. The questions will appear concurrently with appropriate answers and responses. Quick links and Popular Topics are shortcuts directing you to what you could be looking for without much effort.

Conclusion

For income earners looking for a solution to their financial needs, UnionBank quick loans make a perfect option. Notably, UnionBank has earned a reputation as one of the best digital financial institutions in the Philippines. Therefore, as long as you are a verified member of Union Bank, you can rest assured of affordable and easily accessible quick loans. The lender allows you to access instant cash at a fixed interest rate of 4% for loan amounts of up to 1,000,000 Pesos.