When a person lacks the means to improve their financial well-being, resulting to financial facilities for financial assistance is the next best option. Most financial institutions require customers to fill out numerous forms before giving them funds. Cashalo has every customer’s back, offering them a simple and more convenient way to get credit. Founded in 2018, Cashalo was designed to ensure that its borrowers’ financial state is excellent as long as they are in the Philippines and meet the requirements.

About Cashalo

Sometimes a customer may lack funds to kickstart their project and may not know where to obtain the funds. Any Philipino above the age of 21 can improve their financial well-being by applying for credit. Downloading the Cashalo app enables borrowers to obtain credit, helping the county achieve financial inclusion. The app requires customers to submit information on all required areas, followed by verification before the funds are disbursed to their account.

Cashalo, a FinTech company that offers credit, is financed by Paloo Financing Inc. and has SEC registration number CSC201800209. The Securities and Exchange Commission (SEC) gives authorization to financial companies in the Philippines.

Cashalo – Cash Loan and Credit App

Here are the easy steps for customers to follow to apply for loans successfully:

- Customers log in to the Cashalo platform with their mobile number. They get a verification code on their mobile number.

- Under Cash Loan, tap ‘Apply Now’.

- Complete profile. The Cashalo platform requires borrowers to input their personal information, which is vital for background checks.

- Select the amount and read the terms.

- Choose their preferred cash-out option. Customers can select Gcash, their nominated bank, or their PayMaya account.

- Complete submission and wait for approval.

Advantages of Borrowing Money from Cashalo

Below are the reasons why borrowers should take loans from Cashalo.

Financial Literacy Training

Cashalo offers a free financial literacy program for Filipinos to help them enhance their financial well-being through excellent money management and responsible borrowing.

Faster Approval

Through a quick review of applications, a borrower’s funds will be in their account within 24 hours.

Numerous Repayment Option

Cashalo has numerous payment options available for borrowers making the process easy. The options include online, over-the-counter banking, and remittance centers.

Transparency

The interest and fees are clearly outlined, and the repayment information is available at the customers’ disposal.

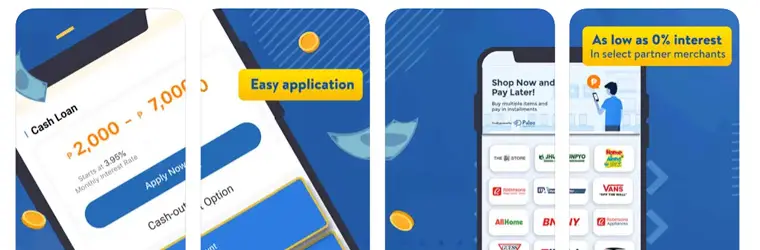

Simple Application Procedure

Borrowers can follow the simple instructions and apply for funds faster.

Cashalo Promotions

Cashalo has several promotions from time to time, some seasonal and others are long-lasting. Customers should check the promotions page occasionally to keep up with the current offers. Some seasonal offers include member referral promotions. Other long-term offers include:

- Repay via ShopeePay – Through this, borrowers can get P100 off if they are Shopee users and pay their bills via ShopeePay.

- Get P200 off a Customer’s First Installment Shopping – Borrowers need to download the Cashalo app to enjoy this offer. Customers should click the ‘Apply Now’ button to get a limit. After approval, they will receive the P200 coupon on the Cashalo account.

Types of Loans Offered From Cashalo

Cashalo helps customers solve emergency needs without paperwork. Cashalo operates under Paloo financing, which finances money given to customers as a credit. The platform has three types of loans which each borrower needs to understand to select the most suitable one. Depending on each borrower’s needs, they can choose what suits them most.

Cash Loan

Borrowers receive cash from their bank through cash credit that helps them sort their financial needs. It is disbursed in less than 24 hours.

Lazada Loan

Through Cashalo, a customer can shop through Lazada and make the compensation later. After their application, the credit is sent to their Lazada wallet.

Cashalo Buy Now Pay Later

Customers can shop at 0% interest in installments and pay later in Cashalo partner stores or merchants.

How to Apply for Funds in Cashalo

There are simple steps for applying for funds on this platform. Customers should set up their account using their registered number to log in to the website or app. They should then tap the ‘Apply Now’ button under cash loan. The next step involves customers completing their profiles by filling in the required spaces.

After creating an account and submitting valid information, a borrower can select the amount of money they require to get out of their financial predicament. The next step should be selecting the appropriate cash-out method, for instance, GCash, PayMaya, or a Bank account. The final part of the application process involves completing the loan application and waiting for approval and disbursement of funds,

Borrower Requirements and Documentation

Borrowers do not need to upload numerous documents for applications with Cashalo. People above 21years are eligible, and the following documents are required.

- Personal information details, such as a Philippine passport or government-issued ID.

- Proof of billing; details of residence, water, and power bills.

- Work information; a valid work ID and recent payslip are required.

- Nominated bank account details; indicates account number where the money will be disbursed.

Application Process

Borrowers should download the Cashalo app and then go to the ‘Apply Now’ button on the Cashalo platform. The application process is fast, and it takes less than 5 minutes. Below is an overview of the application process to help customers improve their financial well-being.

Step 1

Create an Account

If a borrower is a new user, they should create an account that enables them to fill out the application form.

Step 2

Complete Profile

Customers should give proof of nationality, proof of billing, and work information.

Step 3

Choose the Amount

Clients should decide how much money they need to overcome their financial hurdles.

Step 4

Choose a Cash-Out Option

Customers should choose how they want the funds cashed out and check the website to find suitable methods.

Step 5

Complete the Application

Finally, customers should read the terms and conditions and agree to them. They can then wait for approval and disbursement of the credit.

Ways to Get Your Money

Cashalo offers numerous ways to receive your credit through Paloo Financing because of its excellent financial inclusion program. The first option involves using your dedicated account to ensure that the account is active for seamless loan transfer.

If you have a Gcash or PayMaya account, you can also use either of them to receive your money. For secure access to your funds, the Cashalo platform will send an SMS to the phone number linked to your preferred platform.

Methods for Repayment of the Loan

The credit is immediately disbursed if a borrower signs up through the mobile application due to the fast disbursement plan. A faster compensation will equal a smoother transaction and ensure a customer is reloaned on time. The numerous repayment methods offered by Cashaloan are as shown below:

- Online payment via E-Wallet.

- Over-the-counter through Bayad Center, BDO Branches, 7- Eleven, SM Business Centres, Digipay,

- Online banking through the Cashalo website, BDO Online Banking, and Robinsons Online Banking,

- Remittance centers through Touchpay or Cebuana Lhuillier bills can also be used.

Conclusion

Cashalo FinTech company is a world-leading financial credit Company. It is devoted to providing secure access to loans for all eligible Filipinos. Filipinos can boost their business and solve small financial needs through financial inclusion programs. All applications and transactions are performed in a safe environment and backed by the latest technology to ensure the safety of all information transmitted. Therefore, the platform designed Cashalo loans to help its customers with their financial needs, whether short-term or long-term.