Online loans are lifesavers for many people, and CashXpress is one of the lenders you can turn to. When you need quick cash, you want a reliable solution that won’t get you into more debt than you can handle. With an online loan, you don’t need to provide collateral for a lender to advance the money. An online application also means you can do it from anywhere. CashXpress Philippines caters to borrowers who require small amounts at favorable loan terms. Is the lender suitable for your borrowing needs? Does it offer good service compared to other similar lending companies? Find out in this CashXpress review.

About CashXpress

Registered with the Securities and Exchange Commission, CashXpress South East Asia Lending Inc. is a finance company that operates an online loan platform. It offers fast and convenient loans for Filipino borrowers. CashXpress lends cash for various purposes, including emergencies. The lending website allows quick application with a few requirements, meaning many individuals can qualify. You can be confident CashXpress Philippines is a legitimate and safe lender because it bears the seal of transparency from the National Privacy Commission (NPC). The online lending platform provides products that meet the most urgent borrowing demands. Whether you are employed or self-employed, you can find a suitable loan.

Loans offered by CashXpress

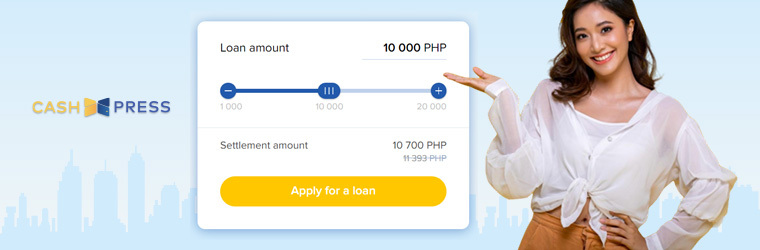

The online lending service offers unsecured loans. It means you don’t have to put up collateral to borrow money. You can ask for a loan amount of between 1,000 PHP and 20,000 PHP. Since the loan range is not very high, the facilities are suitable for small cash emergencies and personal use. The lender charges an interest rate of up to 5% per month, but it varies with the loan amount. Your first loan doesn’t incur any interest and comes with a loan term of 7 days.

However, if you decide to get an extension, then the necessary interest rate applies. The website displays the amount you can borrow on your CashXpress account. Depending on your eligibility, you can get a loan period of up to 30 days. The platform avails a calculator to help you calculate how much you can borrow and pay back.

Advantages of Borrowing Money from CashXpress

Why should you consider taking out a loan online at CashXpress? The most obvious reason is that you can do it online. You can apply for a loan from anywhere, granted you can access the internet. This convenience appeals to any borrower requiring an urgent solution to a cash emergency.

The simplicity of the application process saves time and is painless. When you require money fast, you can’t afford to go through the lengthy process involved in traditional loan products. At CashXpress Philippines, you can create an account in minutes, then log in and submit your application. If approved, in less than 24 hours, the money will be in your bank account.

You don’t have to present a lot of documents to borrow money. The uncomplicated CashXpress loan requirements allow many people to qualify. Your credit score and history don’t have any bearing on your eligibility.

CashXpress transparently presents all loan information. It doesn’t hide charges in the fine print to trap borrowers. From the get-go, you know the loan terms, including the interest rate, loan period, and repayment conditions. So, you can decide if the product is for you or not.

How to Get a Loan from CashXpress Philippines

So, you think the lending platform is perfect for your online loan and decide to take out your first loan. How do you proceed? The company has taken the hassle out of the borrowing process. It takes less than 15 minutes to open an account and fill out the application form. The lender uses the details you provide to evaluate your eligibility. Therefore, ensure all information is accurate and current. After processing your application, CashXpress will approve your loan or not. If approved, the cash is transferred instantly to your bank account, enabling you to use it as soon as you can access it. Before applying for a loan on the website, find out what else you need.

Borrower requirements

CashXpress requires you to meet the following criteria to apply for a loan:

- You must be a citizen and current resident of the Philippines to apply for an online loan

- The qualification age is 21-70 years

- You need an active mobile number

- Have a stable source of income or salary; you can be employed or self-employed

- You must own a bank account or an e-wallet, like PayMaya or GCash, to receive money

- Have a Social Security System (SSS) number

Documentation

When asking for a loan from CashXpress Philippines, you have to present valid identification. It can be your SSS number, passport, UMID, national ID, or driver’s license. You must submit a picture of one of these mandatory IDs and a photo of you holding the same ID. If employed, you must provide the name and contact details of your direct supervisor or HR; 1-2 work colleagues; 1-2 personal references (persons in the same household or relatives). A self-employed applicant must submit DTI certification, mayor’s permit or business permit; contact and personal references; details of trade supplier; and a link to the online shop if applicable.

The Application Process

Are you getting your first loan? Here’s what to do:

Step 1

Register a CashXpress account by clicking the button at the top-right.

Step 2

Fill out the application form. Ensure all details are correct.

Step 3

Upload the necessary documents and images, including your ID and selfie.

Step 4

Give your consent to get the loan.

Step 5

If approved, you will receive a verification code on your registered phone number.

Step 6

You will receive money in your bank account or e-wallet immediately.

How long does it take to get approved?

Once you complete and submit your application, the lending company processes it in less than 24 hours. The lending company CashXpress reviews on a case-by-case basis. Thus, no standard processing period applies. Avoid delaying the procedure by providing all the required documents and information during registration. Don’t risk your application getting rejected or taking longer than necessary due to incomplete requirements. Note that the initial loan might take longer than a subsequent one.

Ways to obtain and repay the loan

Getting a loan on the CashXpress website is painless as long as you satisfy the conditions. You receive money in the bank account or personal waller provided during registration. Then through online banking, you can withdraw the funds or pay bills as necessary. CashXpress makes loan repayment as stress-free as the application. It supports multiple payment channels. Hence, your only concern should be selecting the most suitable payment method. You can pay via GCash, 7-Eleven, and CLIQQ. Each alternative comes with a payment instruction. Make sure you repay according to the loan term to avoid late fees. Here’s how;

- Log in and enter the repayment amount.

- Click ‘Repay’ to open the Dragonpay window.

- Input your preferred method.

- Tick the box to agree to the terms.

- After the site generates a unique reference number, write your email or phone number and then click ‘Send Instructions.’

CashXpress Philippines Customer Service and Contacts

The lending company makes certain you get help if any problems come up. It has hotline numbers you can call if the issue needs urgent attention. At the bottom of the website are three numbers – landline, globe, and smart. So, you can pick the best one. Do you prefer sending an email? Then you have different alternatives to contact CashXpress.

It has an email address for payment concerns, verification queries, application assistants, and general information. Decide in which category your problem falls and choose the corresponding contacts. Whether you want to follow up on a loan amount request or ask about a loan extension, the lender makes the process uncomplicated. Customer service is available Monday-Friday from 8 am to 8 pm and 9 am to 6 pm on Saturday and Sunday.

Conclusion

CashXpress solves varied problems for Filipinos in need of fast cash. The lending company streamlines the loan application process, allowing more people to borrow money. You can expect reliable services when working with the lender. Although the requirements may be more than what most lending apps ask for, the platform remains a viable solution. It has decent terms that many borrowers will find agreeable. A mobile-optimized site ensures you can apply for and repay your loan from your smartphone or tablet. If you need a company with efficient loan services, then consider CashXpress South East Asia Lending Inc.