Finbro makes online lending simple. This user-friendly platform is open to just about everyone in the Philippines. Once you’ve created an account and selected a loan agreement, you’ll get a response within 24 hours. If your loan is approved, you’ll receive funds in your bank account in minutes. Furthermore, repayment terms are very generous. With flexible minimum repayment options and competitive interest, Finbro is one of the best lending platforms around. Looking for financial support for business endeavors? This lender also provides a selection of small business loan products.

About Finbro

Finbro is an online lending platform designed to help everyday users cover unexpected expenses. It’s easy to complete your loan application online, with quick approval and prompt payments to your preferred bank account. Interest rates are competitive and in line with other lending companies. What’s more, flexible terms and minimum payment options mean users don’t have to pay everything back at once. Online loans are available to most people holding Filipino citizenship. However, anyone looking to make an application will need to provide a valid form of ID, as well as proof of a regular income.

Loans Offered by Finbro

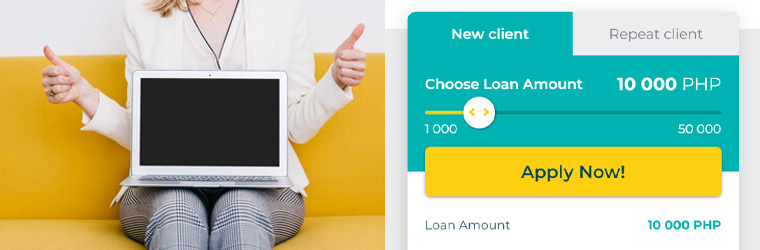

Finbro offers a range of online loan products. Finbro Quick Loans start from as little as PHP 1,000. However, larger loan amounts of PHP 50,000 are also available. Payment terms are generous, with customers able to repay the amount over a period of 12 months. The interest rate is charged at 0.16% per day. This makes it a very competitive online lending service. An additional processing fee is added to the loan amount itself.

Additional money can be borrowed on top of an existing loan amount. However, you’ll need to submit a second loan application for approval. Finbro also offers loan products for small businesses. You can borrow up to PHP 200,000 and repay over a period of 9 months. However, borrower requirements for business loans are stricter. Credit ratings will be more heavily scrutinized and you may have to pay a higher interest rate.

Advantages of Borrowing Money from Finbro

Finbro is one of the most user-friendly online lending platforms around. You can use it for occasional financial support to meet unexpected expenses. Depending on your circumstances, you can select a loan amount of up to PHP 50,000. Provided you have all information required to complete your loan application, approval can take just a few minutes. In most cases, applicants will receive a response within 24 hours.

Once approved, payment is made to your bank account. Although you’ll need to cover interest rate charges and a processing fee, repayments are affordable. The cheapest way to repay your loan is to make a full payment after 30 days. However, you can also choose to make a minimum repayment if you encounter any unexpected expenses. If you’re looking for a hassle-free online lending provider with flexible terms, Finbro is the obvious choice.

How to Get a Loan from Finbro Philippines

Applying for a loan takes just a few minutes. To get started, select the loan amount you’re looking to borrow and your preferred repayment terms. During your online application, you’ll be provided with processing fee specifics and any interest rate charges.

To complete your application, you’ll need to add personal details and provide all the necessary documentation. If you’re applying for your first loan, this will include a selfie and a valid form of ID. Once completed, you’ll need to wait for the lender to approve your application. If successful, you’ll receive money in your chosen bank account.

Borrower Requirements

In order to secure approval and receive money, borrowers need to hold Filipino citizenship. Potential borrowers also need to be aged between 20 and 65. Ideally, borrowers should be in full-time employment. Alternatively, you’ll need to provide evidence of a regular source of income. Applicants also need to have an active checking account for the loan amount to be paid into. Additionally, applicants need to have an active mobile number for communication purposes.

Documentation

To complete a loan application, you’ll need at least one form of valid ID. Accepted forms of ID include a driver’s license, a Unified Multi-Purpose ID (UMID), or a Tax Identification Number (TIN). Social Security System (SSS) credentials can also be used as a form of ID when borrowing from this lender.

The Application Process

To get started, head to the Finbro website and select the amount you’d like to borrow. Once you’ve done this, select “Apply Now”. First-time users will now be redirected to a new page where they can create an account. If you’re a returning user, simply log into your Finbro account to get started with your application.

New customers will need to add personal information and upload a valid form of ID if they’re applying for their first loan amount. Once this is done, your application is ready to be processed. In some cases, Finbro customer support may need to get in touch to request additional information. To ensure swift approval, ensure you provide any requested documents as quickly as possible.

Once approved, you’ll receive money in the bank account selected during the application process.

How Long Does it Take to Get Approved?

This all depends on the amount you are looking to borrow and whether or not Finbro requires more information from you. Some customers will receive a loan approval confirmation in as little as 10 minutes. However, most applications will be completed within 24 hours. In either case, you should hear back about your application by the following working day. Regardless of the outcome of your loan application, you’ll be notified via SMS. Returning customers who’ve used the service before should benefit from faster approvals when making an application.

Ways to Obtain and Repay the Loan

Successful applicants will have their loans paid directly via bank transfer or to an e-wallet. However, you’ll need to be the named holder of the bank account or e-wallet in question.

Repaying your loan is simple. You can head to any of Finbro’s partnered payment centers in person. These include Cebuana Lhuillier, SM Payment Center, and TrueMoney. Alternatively, you can make a transfer online using Finbro’s Union Bank credentials.

When it comes to repayment, you can choose to repay the full amount within 30 days. This way, you can incur no additional costs. Alternatively, you can choose to make a minimum payment. However, you can’t continue doing this beyond 12 months. What’s more, you’ll incur additional charges and interest fees.

Finbro Philippines Customer Service and Contacts

If this is your first time using an online lending provider, customer support is essential. The good news is that Finbro boasts a dedicated customer service department to handle all borrowing and repayment queries. If you prefer speaking to an agent in person, you can get in touch by calling either 969-0471419 or 977-1216391. Both lines are open between 8:00 and 17:00 from Monday to Friday. Do you need to send documents or attached files? You can also email customer support at info@finbro.ph.

Conclusion

If it’s your first time borrowing money online, Finbro is an excellent lending option. The application is straightforward, with no confusing forms to fill in. Furthermore, most forms of valid ID are accepted and anyone with a regular source of income is welcome to apply. Competitive rates and flexible repayment plans make this an ideal alternative to conventional borrowing.