Imagine waking up and finding out your plumbing system is damaged, but you have no money to cover the repairs. You can’t wait for your monthly salary because then the problem will get worse. Maybe you consider applying for a traditional personal loan, but your credit score is not good enough. In such a case, an online loan would be an ideal solution.

Filipinos have more than enough options to choose from among instant loans. PesoQ is one of them. The mobile lending app offers quick cash loans to borrowers across the country. Before getting on the platform to apply for a Peso loan, know what to expect from the lender. We compiled all the essentials about the app in this guide.

About PesoQ

The service operates under the registered name, U-Peso Lending Investors Corp, assuring customers that it has legit online loans. Since the financing company is licensed by the SEC, it is under strict regulations, including providing fair terms. The company has been providing cash loans in the Philippines for a few years and built a reputation for fast loan disbursement. For this reason, it’s one of the leading lending solutions for urgent loans. PesoQ is available as a mobile application where all transactions happen. The app is available for Android and iOS devices. With the PesoQ loan app, you can apply for loans anytime and anywhere. All it takes is a stable internet connection.

Loans Offered by PesoQ

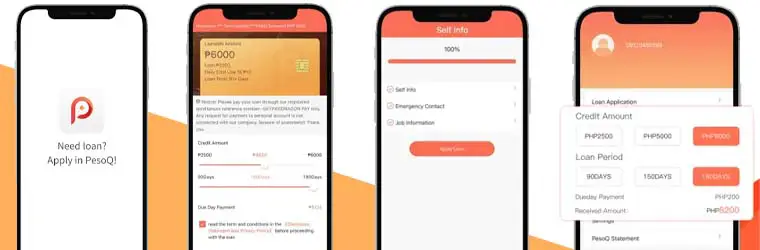

As with most mobile lending apps, PesoQ doesn’t have a high maximum loan cap. A PesoQ loan can be between PHP 1,000 and 10,000. Therefore, the app is only a practical alternative for small loans. The way it works is that you apply for a Peso loan if your chosen amount, pick a loan term, and then repay the money with a monthly interest once the duration is up. PesoQ gives online loans for 90 to 180 days at an interest rate of 0.05% – 0.06% per day.

When choosing the amount to borrow, the app lets you decide the payment date. For example, if you believe you can repay in 21 days rather than 30, then you can select that term. When using the PesoQ app for the first time, you only qualify for the minimum amount. Your loan limit grows as you continue borrowing. The lender tracks your credit rating, which increases with every cash advance and timely repayment. Don’t forget, though, that the more you borrow, the higher the interest. So, only borrow what you can pay back within the deadline.

Advantages of Borrowing Money from PesoQ

The hassle-free loan application and approval process is a major motivator to use PesoQ to borrow money. Once you have the app, you only have to sign and follow the easy instructions. The app has a simple user interface with prompts guiding you through the process. Even with minimal tech knowledge, you can work your way around the platform and take out a loan without any problem.

Urgency is what drives most people to get instant loans. When you have no other recourse but to borrow money to solve an unexpected problem, you want the process to be as fast as possible. PesoQ is one lender that is only too happy to oblige. The lending app has some of the fastest approval times, averaging 15 minutes.

Convenience is another PesoQ selling point. You can take out a loan using the app from anywhere. If you are on the bus and get news that a loved one needs money quickly, you can open the app and borrow the necessary amount. After the initial application, subsequent loans are easier to apply for.

How to Get a Loan from PesoQ Philippines

Have you ever taken out an online loan? The procedure is generally uncomplicated, hence the appeal. PesoQ is as stress-free as most mobile lending apps available for Filipinos. It has minimal requirements and efficient services. In less than an hour, you could apply for a business loan, get approved, and receive the money. Here’s what you need for the process:

Borrower requirements

You must be at least 18 to get a loan from PesoQ. The maximum age limit is 60 years. Applicants must be citizens residing in the Philippines. The lender requires you to have a stable monthly income to apply for a loan to ensure you can repay it. You also need a working phone number. A bank account is necessary for the loan transfer. So, apply for one or activate it if it’s dormant before asking for a loan.

Documentation

Many borrowers find traditional loans tedious because they ask for too much paperwork. The absence of some documents also means you could fail to qualify for a conventional personal loan. PesoQ only asks for basics. You need an ID, which can be a government ID, passport, driver’s license, PRC ID, or UMID. The lender also needs your employment details and the bank account required for funds disbursement. If you are unsure what to submit or how to do it, then contact online customer service for clarification.

The Application process

Step 1

Download the App

Go to the Play Store (Android) or App Store (iOS) to download the native PesoQ app. Once installed, open the app to begin the application process.

Step 2

Pick a Loan

Specify the amount you intend to borrow and the loan term. The app will show you the repayment depending on the applied interest rate.

Step 3

Agree to the Terms

Read the loan agreement before checking the box to agree with the T&Cs.

Step 4

Complete the Form

Fill out the online loan application form with the required details. Provide your full name, address, a valid mobile phone number, email address, monthly income, and bank account.

Step 5

Submit Your ID

You have to upload a clear photo of one of the major IDs. Check all details to ensure they are accurate and send the application.

Step 6

Wait for Approval

Keep your phone on while waiting for a loan consultant to call you.

How long does it take to get approved?

The online money lending company approves loans in less than 15 minutes. After you finish the application, the lender has to review it before making a decision. If everything is in order, you can receive a response in as few as 5 minutes. The process doesn’t take more than 24 hours. Make certain you complete the application correctly and meet all the requirements to speed up the approval. PesoQ alerts you via SMS if you get the loan.

Ways to obtain and repay the loan

If approved for a loan, you will receive the money via bank transfer. The app sends the cash directly to your account or card, then you can access it as necessary. Alternatively, you can receive loan proceeds in your digital wallet. The platform lists the services it partners with. Coins.ph, GCash, and CliQQ are examples. Alternatively, you could opt to pick up the funds from a remittance center or a merchant. Find out which ones are available for loan disbursement.

Repaying a Peso loan is just as convenient as getting one. You can transfer payments through online banking or an e-wallet on the mobile app. Choose your preferred option and authorize the payment. Other repayment alternatives are convenience stores and remittance centers, like 7-Eleven and M. Lhuillier.

PesoQ Philippines Customer Service and Contacts

Through its online customer service, PesoQ ensures borrowers can ask for assistance regarding various matters. The official website provides an email contact you can use to communicate with the support team. However, you can email directly from the app. Navigate to the online customer service section on the contact us page. The app provides hotline numbers which you can use during working hours – Monday to Saturday, 8:30 am – 5:30 pm.

Conclusion

The option to borrow money online makes sense for many people because it is incredibly accessible. With PesoQ, you don’t need additional documentation except for your ID and employment details. You also don’t have to worry about non-existent or poor credit history. So, you can get the money you need without jumping through too many hoops. You can get a cash loan for different uses, such as home improvement projects, utility bills, and medical treatment. Whatever the loan is for, make sure you weigh the benefits and disadvantages before getting one.