About Tala – Is the Company Legit?

If you have ever needed an online loan in the Philippines, then you must have come across Tala. It’s one of the leading options for online loans in the country. Tala is a global company founded in California by Shivani Siroya, who is also the CEO. Besides the Philippines, the lender operates in India, Kenya, and Mexico. The company was founded on the belief that everyone should have access to lending facilities. Tala is licensed and registered with SEC (Securities and Exchange Commission), authorizing it to provide lending services. Therefore, customers can be certain they are borrowing from a legitimate platform.

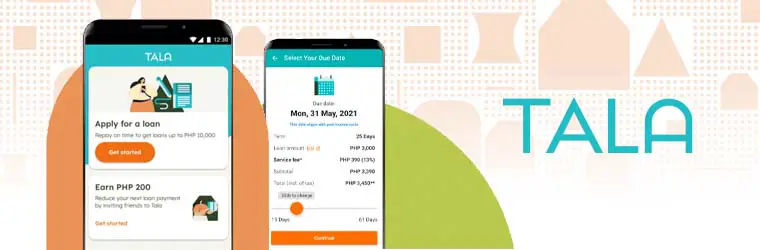

Tala Loan App

The lending company operates via an Android mobile app. So, you must have a compatible smartphone to download the app and apply for your online loan. Tala takes the hassle out of the loan application process. Once you confirm your identity on the app, you can apply for a quick cash advance and wait to receive the money within the day. With the lending app, you can ask for funds from anywhere, and at any time. For this reason, Tala is ideal for emergencies. When you have to pay for medical bills, appliance repairs, or utilities and don’t have money, you can use the Tala app. Unlike a credit institution, you don’t have to wait in line or fill out paperwork.

Advantages of Borrowing Money from Tala

Online loans appeal to many borrowers because they are uncomplicated, and no other lender demonstrates that better than Tala. The biggest plus point of the lending app is that it is simple to use. Once you confirm your details and create an account on the platform, a loan is only a few taps away. Hence, the lender is ideal for individuals who would rather avoid the stress of putting together various documents like what happens with a traditional credit institution.

Tala makes it easy to get online loans even with bad credit. A poor credit score disqualifies you from various conventional products, and the loans available have ridiculous interest rates. With the lending app, Filipinos can borrow without worrying about credit checks. Tala is also suitable for urgently needed money because it has quick approval and disbursement. Thus, it’s perfect in an emergency.

Loans offered by Tala

The Tala app gives out loans according to an applicant’s requirements. Online loans are available at interest rates of between 14.54% and 15%. The amount you borrow determines the interest rate charged. Tala gives you the option to choose the tenure. It can be 21 or 30 days. The loan term also affects the interest rate you get. Therefore, be sure you pick a loan term you can meet. A first-time borrower can receive PHP 1,000 – 2,000. After consistent repayments of several online loans, your limit increases. The app lends up to PHP 15,000. Depending on your borrowing frequency, you can double or triple your limit in a few months.

How to Apply and Get Your Loan

Tala is one of the simplest platforms to use for an online loan. The loan application process takes several minutes. New customers have to upload their IDs to the app when applying for the first time. After creating an account successfully, subsequent loan applications take less than two minutes. If approved for a loan, you can receive money from any one of Tala’s remittance centers, such as M Lhuillier, Cebuana, and Palawan Express. Cebuana is the best option if you need a quick money transfer. Alternatively, the money can be deposited in your bank account or Coins.ph wallet.

Documentation Required

The biggest advantage Tala has over a bank or Filipino credit institution is that you don’t require a lot of documentation to apply for a loan. Even when applying for personal loans online, some lenders ask for proof of address, a bank account, and proof of income, among others. The lending app only asks for a valid ID. Tala accepts a national ID, driver’s license, postal ID, voter’s card, PRC card, passport, or UMID/SSS ID. During the loan application, customers must submit various personal details as well.

The Application Process

Applying for a Tala loan takes a few minutes. Here’s a quick guide:

Step 1

Get the app

Install the Tala app from Google Play Store. You need an Android 4.0 or higher for the download.

Step 2

Sign Up

Once the app is ready, open it and click ‘Sign Up’ to start the registration process.

Step 3

Enter Your Mobile Number

Submit and verify your mobile number to receive a verification code. The app detects the code automatically and auto-fills it. If not, enter the four-digit code and hit ‘Next.’

Step 4

Create a PIN

Tala will ask you to enter a four-digit PIN, which you will use to access the app. When done, tap ‘Continue’ and then ‘Apply.’

Step 5

Complete the Form

Read the loan application instructions the app displays. Click the ‘Get Started’ button, and fill out the form. Check your answers before hitting ‘Continue.’

Step 6

Wait for Approval

Give the process a few minutes. If approved, the app will show the available loan offers. Pick the repayment option, accept to borrow, and wait to receive money.

How Long Does It Take to Get Approved?

Loan approval at Tala takes approximately 5 minutes. Once you complete the application, you have to wait for processing. You then receive a notification on the app on whether you qualify for a loan or not. After your first cash advance, the next loans take even shorter to be approved. If you repay in time, the platform informs you immediately if another loan limit is available. The speed of approval of Tala loans is why they are ideal in urgent situations.

Conclusion

If you can’t qualify for a conventional personal credit facility and prefer not to use an independent broker, then Tala is one solution to consider. The lending app makes borrowing uncomplicated by putting the whole process at your fingertips. Besides its simplicity, Tala doesn’t impose too many fees that eat into your loan proceeds. The provider is a reliable, secure app that protects customer data. Nonetheless, ensure your information is always safe.